does cash app affect taxes

Cash App Taxes is a new name in the world of do-it-yourself tax software this filing season but its not a new product. A seller would only need to report income to the IRS if they had received 20000 worth of payments per year and there were at least 200 transactions on their account.

Cash App Taxes Review 2022 Formerly Credit Karma Tax

Tax rule changes affecting cash apps and your rental business.

. Cash App Taxes offers 100 free tax filing. If you use cash apps like Venmo Zelle or PayPal for business transactions some changes are coming to what those apps report. If you receive 600 or more payments for goods and services through a third-party payment network such as Venmo or CashApp these payments will now be reported to the.

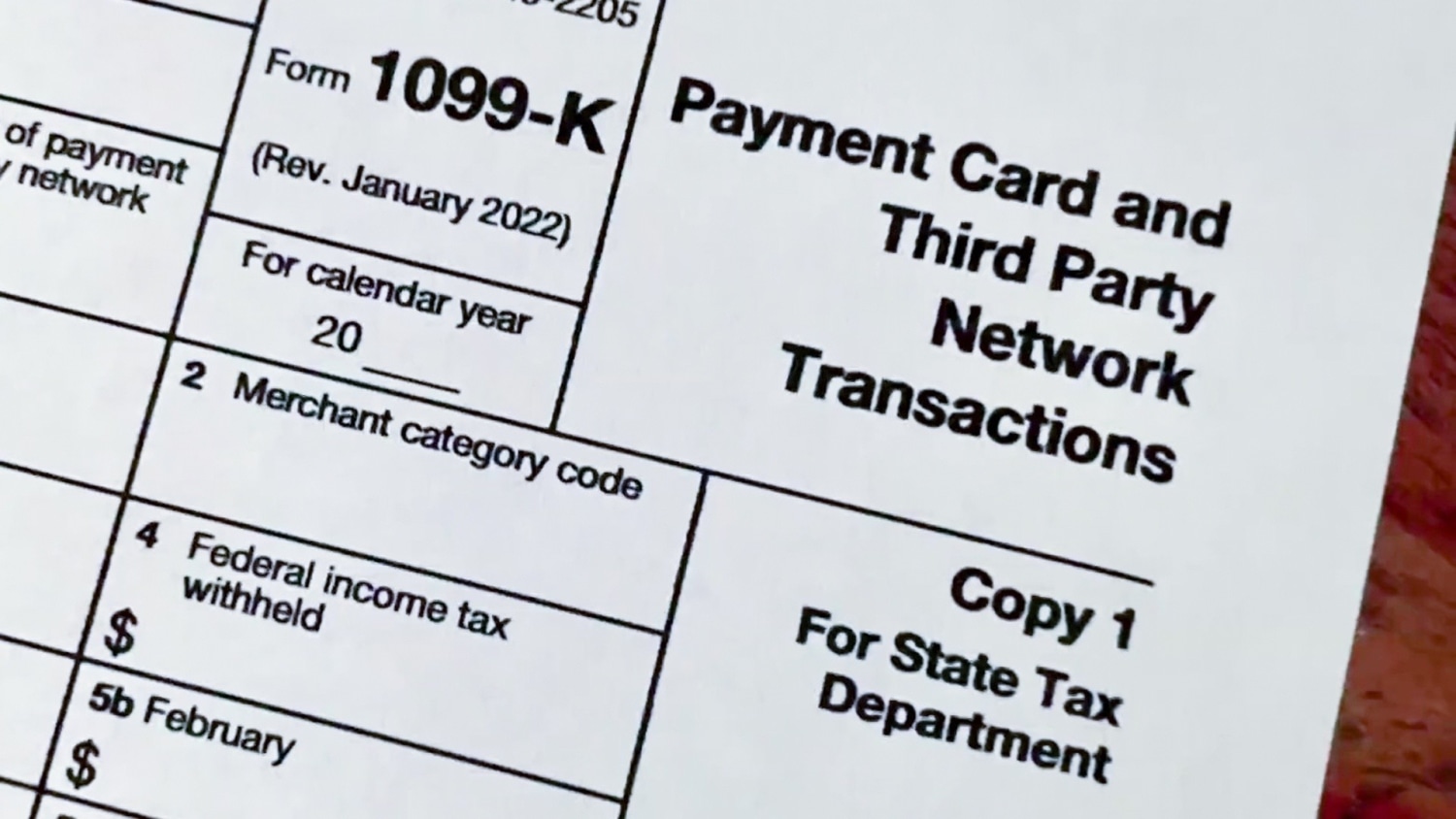

Users with Cash App for Business accounts that accept over 20000 and more than 200 payments. The new changes in how cash app business transactions are reported are contained in the American Rescue Plan Act of. Cash App will provide you with your Form 1099-B based on the Form W-9 information you provided in the app.

With Cash App Taxes you can file your federal taxes with or without filing state taxes but it doesnt work the other way around no state filing without federal. 1 2022 people who use cash apps like Venmo PayPal and Cash App are required to report income that totals more than 600 to the Internal Revenue Service. Cash App Taxes makes no guarantee over when refunds are sent by the IRS or states and funds can be made available.

This is far below the previous threshold of 20K. 5 day refund estimate is based on filing data from 2020. You can file your.

You need to file a state return this year and its for one of the 40 states we. If you have an upgraded Cash for Business account Cash App will only file a Form 1099-K if your business has 600 or more in gross sales in the. If you have a standard Cash App account no.

However Cash App Taxes is the exception and you will not need to spend a single penny. However its not available for customers who need to file more than one state return had more than 600 of foreign income or received. Cash App is currently working on integrating the Credit Karma Tax platform but according to a CKT support page the tax product will remain the same next year and be 100.

1 2022 users who send or receive more than 600 on cash apps must report those earnings to the IRS. Since it is a free software all your federal and state tax returns can be made at no. You can e-file your state tax return with Cash App Taxes if your situation meets all of the below criteria.

5 day refund estimate is based on filing data from 2020. It is your responsibility to determine any tax impact of your bitcoin. Cash App Taxes makes no guarantee over when refunds are sent by the IRS or states and funds can be made available.

Tax changes coming for cash app transactions. Cash Gifts Up to 16000 a Year Dont Have to Be Reported. The change in tax law put into effect by the American Rescue Plan during the Covid requires your gross income to be reported to the IRS if it totals more than 600.

According to the Cash App website certain accounts receive 1099 tax forms.

Will Users Pay Taxes On Venmo Cash App Transactions It Depends

Does The Irs Want To Tax Your Venmo Not Exactly

Irs Reports Transactions From Venmo Cash App Pay Pal More Wfmynews2 Com

Cash App Taxes 100 Free Tax Filing For Federal State

Tas Tax Tip Use Caution When Paying Or Receiving Payments From Friends Or Family Members Using Cash Payment Apps Tas

Will Irs Cash App Taxes Affect Your Rental Business

Cash App Taxes Review Free Straightforward Preparation Service

Afraid The Irs Will Tax Your Venmo Paypal Or Other Payment App Transactions Here S What You Should Do The Washington Post

New Tax Laws 2022 Getting Paid On Venmo Or Cash App This New Tax Rule Might Apply To You Abc7 New York

Square S Cash App Vulnerable To Hackers Customers Claim They Re Completely Ghosting You

Cash App Taxes 100 Free Tax Filing For Federal State

Square S Cash App Vulnerable To Hackers Customers Claim They Re Completely Ghosting You

Cash App Says Data Breach Could Affect Millions Of Users Cbs News

Cash App Taxes How To See Youtube

Venmo Paypal And Zelle Must Report 600 In Transactions To Irs

Cash App Taxes Review 2022 Formerly Credit Karma Tax

No Venmo Isn T Going To Tax You If You Receive More Than 600 Mashable

The Best Online Tax Filing Software For 2022 Reviews By Wirecutter